In this post, you will learn about some of the following insurance applications use cases where machine learning or AI-powered solution can be applied:

- Insurance advice to consumers and agents

- Claims processing

- Fraud protection

- Risk management

AI-powered Insurance Advice to Consumers & Agents

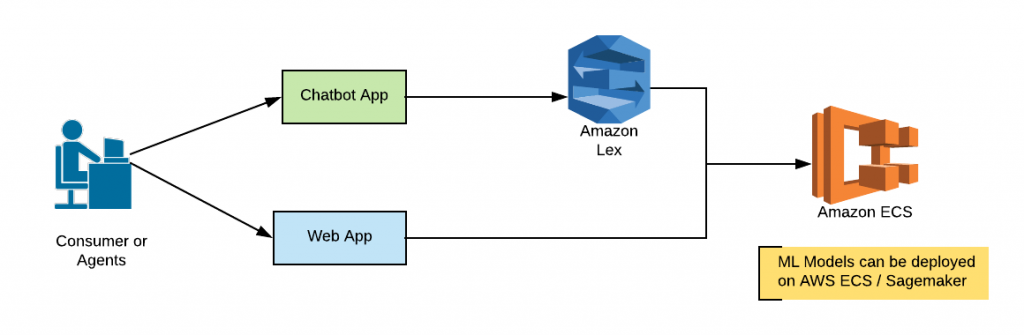

Insurance Advice to Consumers: Machine learning models could be trained to recommend the tailor made products based on the learning of the consumer profiles and related attributes such as queries etc from the past data. Such models could be integrated with Chatbots (Google Dialog flow, Amazon Lex etc) applications to create intelligent digital agents (Bots/apps) which could understand the intent of the user, collect appropriate data from the user (using prompts) and use the underlying model to recommend the tailor-made products. Alternatively, traditionally speaking, consumers could be asked to provide their details using inquiry form and the form submission part of applications could invoke the model to get the recommendation for tailor-made products. The following represents a quick application/technology architecture covering different components of applications including machine learning models deployed on AWS infrastructure:

Insurance Advice to Agents: Machine learning models could be trained to recommend the tailor-made products to agents in relation to health, home, commercial etc to provide accurate information to their clients. These become more useful when there are new products under different category and it gets difficult to train all of the agents working in different locations. A Chatbot application integrated with a machine learning model trained to recommend an appropriate product (especially new ones) based on consumer queries would prove very handy for the agents. The above diagram represents a quick application architecture covering different components including machine learning models.

AI-powered Insurance Claims Management for Quicker Claim Processing

Insurance claims are notifications to the insurance company by the consumers that a loss or damage covered by the policy has happened and the insurance company is required/expected to take appropriate action.

Machine learning models could assist the claim-processing staff members to process the claim in a faster manner thereby leading to quicker payouts (if appropriate) and greater customer satisfaction.

The following represents some of the use cases related to insurance claims:

- Claims document recognition & classification system: AI-powered (OCR-based) claim document recognition and classification system to classify documents, submitted as part of claims, using different channels. ML models could be trained to classify the validity of the document submitted as proof, against the terms and conditions of the insurance policy. Models could be trained to classify the quality of the document thereby triggering an email notification to re-send documents for quicker processing. These models could also be used to assist consumer find out whether there is a valid claim based on the inputs/documents shared by him. The inputs could be collected from the ChatBots or forms and the submission of inputs (self-help portal) could invoke the trained machine learning model to predict the validity of the claim.

- Claims valid or invalid classification system: Multiple machine learning models trained to predict the likelihood estimate of whether the claim is valid or invalid which results in insurance companies accept or deny the claim respectively.

- Claims settlement days prediction: ML models could be trained to predict the number of days it might require to process the claim based on different attributes (features). This would in turn help manage the customers in an effective manner.

Fraudulent Claims Classification ML Systems for Fraud Protection

Insurance companies lose billions of dollars on fraudulent claims submitted as part of insurance applications. The following represents some statistics regarding the fraudulent claims:

- Over the five-year period from 2013 to 2017, property/casualty fraud amounted to about $30 billion each year.

- The Federal Bureau of Investigation said that healthcare fraud, both private and public, is an estimated 3 to 10 percent of total healthcare expenditures.

- Based on US Department of Health and Human Services’ Centers for Medicare and Medicaid Services’ data for 2010, healthcare fraud amounted to between $77 billion and $259 billion.

Machine learning models could be trained to classify the claims as fraudulent or otherwise. The models could be based on OCR system to extract the data (semi-structured & unstructured) from the documents and use several classification models to classify the claim as fraudulent or otherwise, based on the information gathered from the documents.

The following are a different kind of fraudulent claims against which models could be trained for making the predictions:

- Claims padding: Claims padding is considered as “soft fraud”. According to one statistics, around 5 to 25 percent of every claim dollar is lost to “soft fraud” like claims padding. It has been found that those padding or exaggerating consider their act to be okay such that they could recover their deductible, particularly if they’ve paid their premiums on time for years and have never made a claim. ML models could be trained to predict unusually large claims for a particular type of circumstances.

- Inflating actual claims: ML models could be used to identify or classify whether the claim made is inflated.

- Submission of claims for injuries or damage that never occurred: ML models could be trained to classify the validity of claims for injuries or damage that may not have occurred.

AI-powered Risk Management Systems

The following represents some of the core risks against which machine learning models could be trained for prediction:

- Mis-selling & fiduciary risk: One of the key risk types is mis-selling the products to the wrong customer due to wrong customer profiling. Machine learning classification models can be trained to predict (classify) appropriate product for each customer.

- Ethical AI principles for avoiding discrimination: In case there are machine learning models used for predicting services or charges for specific class or group of customers, such models would need to be tested for fairness, and support transparency to examine the disputes raised by the customers at some point in time.

- Risk arising out of Customer Feedbacks: One of the key aspects related to risk management is assessing customer feedback and designing risk strategies. If customer feedbacks are not managed appropriately, customers could hurt the insurance companies reputation by talking inappropriately in social media platforms. Thus, it becomes of key importance to analyze customer feedback and plan appropriate controls/actions. Machine learning models could be trained to categorize & classify the customer feedback. Voice-to-text ML managed services from cloud providers could be used to convert customer audio calls to text and later use NLP and classification techniques to analyse the customer sentiments and classify the customer feedback.

References

- Claims explained

- Background on: Insurance fraud

- How America’s Top 4 Insurance Companies are Using Machine Learning

- Padding insurance claims hits everyone’s wallets

- Maching learning in Insurance

- Do Insurance Companies Really Need Risk Management? *Managing insurers’ compliance risks in a changing environment

Summary

In this post, you learned about four key areas and related use cases where machine learning can be applied to insurance applications. The most important area is claims processing where machine learning models could be trained to achieve quicker claims processing. Other areas including fraudulent claims, risk management and insurance advice where machine learning models could prove to be very useful.

- Questions to Ask When Thinking Like a Product Leader - July 3, 2025

- Three Approaches to Creating AI Agents: Code Examples - June 27, 2025

- What is Embodied AI? Explained with Examples - May 11, 2025

I found it very helpful. However the differences are not too understandable for me