ESG (Environmental, Social, and Governance) benchmarking is an important part of any company’s sustainability strategy. But with so many options available, it can be difficult to know which companies to trust. To help you make the right decision for your business, let’s take a look at some of the top ESG benchmarks which is adopted by the companies across the globe in the market today.

Dow Jones Sustainability Index (DJSI)

The Dow Jones Sustainability Index (DJSI) is an important tool for evaluating how well companies are meeting environmental, social and governance (ESG) goals. The index measures the performance of global sustainability leaders by providing a comprehensive assessment of corporate sustainability practices. It uses a holistic approach to measuring environmental-friendly performance, with multiple criteria being taken into account. The index can be used for benchmarking to compare company performance on ESG issues both within an industry and across industries. The companies such as Microsoft, Pfizer, Sony, IKEA group, Unilever, etc. are using DJSI for tracking their ESG initiatives.

The DJSI is produced by RobecoSAM, a provider of sustainability ratings, indices, engagement programs and other services related to corporate sustainability efforts. The index is based on an annual review of companies around the world covering all sectors and regions. The selection process includes an analysis of financial and non-financial information from publicly available sources as well as from independent research reports from third parties such as the Carbon Disclosure Project (CDP). Companies that meet certain criteria are then considered for inclusion in the index.

For an individual company to be included in the DJSI, it must demonstrate best practice in a number of areas such as leadership commitment, strategy/management systems and stakeholder engagement. Only those companies that meet or exceed thresholds established by RobecoSAM are eligible to appear in the index. Companies on the list are ranked based on their score relative to their peers within each sector or industry group they belong to. This score provides investors with a clear understanding of which companies have made significant progress towards meeting ESG criteria relative to their peers within the same sector or industry group.

S&P Global Sustainability Ratings

S&P Global is a leading provider of ESG benchmarking services, offering comprehensive and consistent analysis of companies’ environmental, social, and governance (ESG) performance. This service provides investors with a comprehensive understanding of how companies are managing their resources to address the most pressing global challenges. S&P Global Ratings has developed a unique methodology for assessing a company’s ESG performance based on an extensive range of criteria including energy efficiency, water usage and pollution control, human rights and corporate governance. The ratings are provided on a relative scale with ‘AAA’ being the best rating.

One of the key features of S&P Global Ratings is that they assign scores across different industry sectors, allowing investors to compare ESG performance between sectors. The ratings also focus on various aspects such as corporate policies, management practices and activities related to climate change, ethical supply chain management and community engagement. In addition, these ratings reflect an assessment of the risk associated with each company’s operations in terms of potential violations of laws or regulations related to environment or human rights issues.

S&P Global Ratings takes into consideration more than 1,000 quantitative measures when assessing firms in order to ensure accuracy and consistency across their evaluations. They use data from over 100 sources such as public databases, research reports, market analysis and information from interviews with relevant stakeholders. Furthermore by utilizing advanced analytics techniques such as machine learning algorithms they can assess a company’s ESG performance over time and make adjustments as needed.

FTSE4Good

FTSE4Good is an ESG benchmarking tool developed by the FTSE Russell, a leading global index provider. It is used to assess the performance of companies based on their ESG criteria with the goal of creating more sustainable investments for both individuals and corporations.

To be included in the FTSE4Good index, a company must meet certain standards related to environmental impact, social responsibility, ethical practices and corporate governance. Companies are evaluated against established criteria that cover a range of topics such as climate change, water use, gender diversity, human rights and prevention of corruption. The process involves engagement between FTSE Russell analysts and external stakeholders such as experts from civil society organizations or other NGOs.

Once companies have been assessed they are given a score which is used to determine whether or not they will be included in the index. The scores are reviewed quarterly to ensure that any changes in a company’s performance are reflected in their overall score. Companies that perform well in terms of ESG criteria can then be included in indices like the FTSE4Good Global Index which tracks the performance of companies meeting certain requirements related to ESG practices. This helps investors to identify companies that take their environmental and social responsibilities seriously.

Bloomberg ESG & Climate Indices

Bloomberg ESG & Climate Indices are a set of indices developed by Bloomberg to measure the performance of companies with respect to Environmental, Social and Governance (ESG) criteria. The indices provide investors with important data about the sustainability performance of companies in various industries, including energy, retail, banking, materials and more. The indices are designed to help investors identify opportunities for investing in sustainable businesses that meet or exceed industry standards for environmental stewardship and social responsibility. They also serve as an important benchmarking tool for companies looking to improve their own performance on ESG issues.

The Bloomberg ESG & Climate Indices use a variety of metrics to assess each company’s sustainability performance. These include measures such as carbon emissions intensity, energy efficiency, waste management and water usage; social indicators such as employee satisfaction surveys, diversity and inclusion initiatives, community outreach programs and safety records; and governance factors such as executive compensation structures, board composition and shareholder rights. Companies are scored on a scale from 1-100 based on these metrics, allowing investors to easily compare the sustainability practices across different firms.

ISS ESG Ratings

ISS ESG Ratings offer an ESG benchmark for organizations to measure their performance. It evaluates organizations on their environmental, social, and governance performance providing a comprehensive assessment of how well companies are managing sustainability issues. The ratings are based on a scoring system that assigns an overall score out of 100, with higher scores indicating better ESG performance. The evaluation criteria includes factors such as management of environmental risks and opportunities, labour standards, human rights, anti-corruption policies and practices amongst many others. Companies receive feedback from ISS ESG for their evaluation results that provides detailed insight into the areas where a company is performing well or where there are opportunities for improvement.

The ISS ESG ratings are designed to help investors make more informed decisions by providing them with data and analysis to assess the sustainability of public companies. They allow investors to evaluate the materiality of ESG risks and opportunities in terms of impact on financial performance, identify best practices in corporate sustainability management, and compare individual company performance against peers. In addition to rating global companies, ISS recently announced its new Sustainable Finance Rating & Analytics (SFRA) platform which provides free ESG assessments for small-to-medium sized companies in Europe. This allows smaller companies to access insights into their own sustainability performance relative to larger rivals.

Carbon Disclosure Project (CDP)

CDP is another leading provider of ESG data and analysis that focuses on climate-related risks and opportunities for organizations around the world. They collect information from thousands of companies across multiple industries on topics such as energy use intensity, emissions disclosure practices, corporate carbon pricing strategies, water usage efficiency measures, green building initiatives and much more. The CDP’s data helps investors better understand how companies are managing their climate-related financial risks so they can make informed decisions about their investments.

Sustainalytics

Sustainalytics is another top provider of ESG analytics and research. They provide comprehensive coverage of over 7,500 listed companies worldwide with detailed information on each company’s performance in areas such as climate change adaptation, human rights, labor standards, resource use efficiency, corporate governance practices, supply chain management, as well as other important factors related to sustainability. They also offer ratings that compare a company’s performance against its peers in order to provide investors with an objective assessment of how well a company is managing its ESG risks relative to other firms in its sector or region.

MSCI

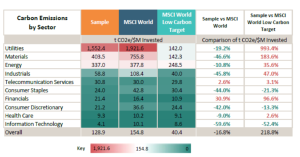

MSCI ESG Research is one of the leading providers of ESG research and analysis. They have comprehensive coverage of over 10,000 publicly traded companies globally. Their data and analytics are used by institutional investors and asset managers around the world to make informed decisions about their investments. Their research covers more than just environmental and social issues; they also include economic factors such as capital structure and dividends. In addition, their database is updated on a daily basis for accuracy and timeliness.

Conclusion

ESG benchmarking is an essential component of any sustainable business strategy – but with so many options out there it can be hard to know which ones are best suited for your organization’s needs. By familiarizing yourself with some of the top ESG benchmarking companies like DJSI, Bloomberg ESG indices, MSCI ESG Research, Sustainalytics, Carbon Disclosure Project (CDP), etc., you can ensure that you are making an informed decision when selecting an external partner for your sustainability efforts. With this knowledge in hand you can rest assured knowing that your investment decisions are based on accurate data from reliable sources who have proven track records in providing high quality services related to environmental social governance issues.

- Mathematics Topics for Machine Learning Beginners - July 6, 2025

- Questions to Ask When Thinking Like a Product Leader - July 3, 2025

- Three Approaches to Creating AI Agents: Code Examples - June 27, 2025

what method is used in determining benchmarks?

what is an ESG company?