Category Archives: Banking

Pricing Analytics in Banking: Strategies, Examples

Last updated: 15th May, 2024 Have you ever wondered how your bank decides what to charge you for its services? Or, perhaps how do banks arrive at the pricing (fees, rates, and charges) associated with various banking products? If you’re a product manager, data analyst, or data scientist in the banking industry, you might be aware that these pricing decisions are far from arbitrary. Rather, these pricing decisions are made based on one or more frameworks while leveraging data analytics. They result from intricate pricing strategies, driven by an extensive array of data and sophisticated analytics. In this blog, we will learn about some popular pricing strategies banks execute to …

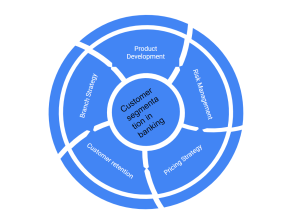

Customer Segmentation in Banking: Examples

Ever wondered how some banks seem to know exactly what their customers need, almost before the customers do? They’re probably leveraging the power of customer segmentation. We all know how vital it is for any businesses including banks to truly understand their customers in today’s competitive landscape. And that’s where the magic of customer segmentation comes into play. It is enabling banks to dive deep into customer data and extract actionable insights, influencing everything from crafting personalized experiences to strategic decision making. In this blog post, we’re going to learn about customer segmentation use cases in banking, showcasing how it’s going to impact product development, risk management, and customer acquisition. …

Underwriting & Machine Learning Models Examples

Are you curious about how AI / machine learning is revolutionizing the underwriting process? Have you ever wondered how machine learning models are reshaping risk assessment and decision-making in industries like insurance, lending, and securities? Underwriting has long been a critical process for assessing risks and making informed decisions, but with the advent of machine learning, the possibilities have expanded exponentially. By harnessing the immense capabilities of machine learning algorithms and the abundance of data available, organizations can extract actionable insights, achieve higher accuracy, and streamline their underwriting practices like never before. In this blog, we will learn about how machine learning models can be used effectively for underwriting processes, …

Loan Eligibility / Approval & Machine Learning: Examples

It is no secret that the loan industry is a multi-billion dollar industry. Lenders make money by charging interest on loans, and borrowers want to get the best loan terms possible. In order to qualify for a loan, borrowers are typically required to provide information about their income, assets, and credit score. This process can be time consuming and frustrating for both lenders and borrowers. In this blog post, we will discuss how AI / machine learning can be used to predict loan eligibility. As data scientists, it is of great importance to understand some of challenges in relation to loan eligibility and how machine learning models can be built …

I found it very helpful. However the differences are not too understandable for me