In the past few decades, many advances have been made in the field of data analytics. Researchers are now able to predict stock prices with higher accuracy due to analytical predictive models. These predictive techniques utilize data from previous stock price movements and look for patterns that could indicate future stock price changes in the market. The use of these machine learning techniques will allow investors to make better decisions and invest more wisely by maximizing their returns and minimizing their losses. In this blog post, you will learn about some of the popular machine learning techniques in relation to making stock price movement (direction of stock price) predictions and classify whether a stock is a buy, sell, or hold. The stock price prediction problem is a fairly complex problem and different techniques can be used appropriately to achieve good prediction accuracy.

Machine learning techniques used for predicting stock prices

Machine learning techniques used for predicting stock prices involve analyzing historical data to predict the likelihood of a future event occurring or forecast future performance. This is done by looking at patterns in the data which includes current and past information and finding the best fit predictive models. Machine learning model with optimal performance can be trained by tuning with different algorithms and associated parameters / hyperparameters. However, predictions made with machine learning models are not usually as reliable as those made by humans. However, the predictive models can be used as augmented intelligence for investors to be take informed decision on investing in stocks that will provide them with higher returns and minimize losses. In recent years, the advent of machine learning and deep learning has provided a greater level of model performancce accuracy for stock prices prediction. Financial analysts and investors have used predictive analytics techniques to improve their ability to predict the price of stocks in the market with relative accuracy.

While using machine learning models for stock price prediction, caution must be taken as the model performance accuracy can vary depending on the amount of data available for model training. For example, there are cases where models could show almost 95% accuracy in one year and then display around 60% accuracy in the next year. This is largely due to the fact that prices in the market are not always clear-cut and there can be changes in certain variables between one period and another, like volume of transactions or number of employees, which will affect price movements. When making decisions regarding using predictive models for stock price prediction, it is recommended to backtest these predictive models and evaluate the quality of the prediction output. This will increase investors’ confidence in the model, giving it a more solid foundation for future uses.

Here are the three most popular or common techniques used for building machine learning models for stock price movement (upward / downward) and classifying whether a stock is a buy, sell, or hold:

Fundamental analysis on whether to buy, sell or hold

In fundamental analysis (FA), the machine learning models can be trained using data related to companies’ financial statements and macroeconomic and microeconomic factors. The models can be used to predict the stock price movement at any given point in time. One can use supervised learning models such as bagging, boosting ensemble classifiers, or deep learning neural networks for making predictions on whether to buy, sell or hold. Feature engineering is key to building a high-performance model and one can go about using feature selection (random forest)/feature extraction (PCA) techniques. The accuracy of these models depends on two factors – the input data used and the type of algorithm selected. For most cases, it is recommended that they be trained for 4-5 years with large quantities of stock price data before results can be expected. The following are a few articles in relation to using machine learning for fundamental analysis technique:

- Fundamental analysis via machine learning

- Analyzing fundamental stock data with ML pipelines

- Machine learning for stock predictions based on fundamental analysis

Technical analysis for predicting stock price movement direction

In this technique, machine learning models can be trained to forecast the stock movement or the direction of prices through an analysis of historical market data such as prices and volumes.

Sentiment analysis for predicting stock price movement

Sentiment analysis is a powerful prediction technique with stocks. Quantitative sentiment analysis helps to measure stock market traders’ expectations about the level of risk and future price movements. In sentiment analysis, machine learning models can be trained to predict the stock price movement using market sentiments (positive or negative word associations) related data gathered from various sources such as financial news, companies’ reports, social media feeds such as tweets, etc. Broadly, the data needed to train such models can come from news/social media sources and stock websites (such as NASDAQ). Different sentiments have different levels of effect on the stock price movement. For example, when sentiment changes from being too bearish to bullish it can cause a sudden upswing in prices which is known as a burst. Algorithms such as random forest etc can be used to train such a model. The model features can be related to the number of news related to the particular stock, company size, company”s market cap, rate of change of stock prices in the last few days, etc.

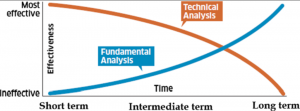

Here is a representative diagram showing which efficacy of techniques such as technical and fundamental analysis for short-term and long-term stock predictions.

Of the three general categories of stock prediction techniques, technical analysis, and sentiment analysis are primarily used for short-term prediction on the scale of days or less. One can aggregate the predictions from the models trained based on the principles of technical and sentiment analysis for greater model performance. Fundamental analysis, on the other hand, is used for mid-term and long-term predictions on the scale of quarters and years.

Conclusion

Machine learning techniques such as fundamental analysis, technical and sentiment analysis for stock price prediction can be very successful when applied correctly. It is important to apply these models in a way that will reduce errors and maximize results. One approach you could take is utilizing data from past transactions in your market or combining it with other investment strategies like technical analysis, fundamental analysis, and quantitative easing. The use of a model based on historical data provides more solid information because it has been previously tested for accuracy in the market; this eliminates incorrect or incomplete data which provides unreliable predictions about future prices movements. Machine learning techniques are also useful at analyzing how different stocks move together over time–for example, if there’s an upswing due to changing sentiments then investors would want to know what caused the positive change so they can invest with more confidence.

- The Watermelon Effect: When Green Metrics Lie - January 25, 2026

- Coefficient of Variation in Regression Modelling: Example - November 9, 2025

- Chunking Strategies for RAG with Examples - November 2, 2025

I found it very helpful. However the differences are not too understandable for me