The procure-to-pay (P2P) cycle or process consists of a set of steps that must be taken in order for an organization to procure and pay for goods and services. Procurement is the process by which organizations purchase goods, supplies, equipment, or services from outside sources. The procurement function may also serve as an intermediary between two internal departments or divisions that have overlapping needs. In this blog post, we will discuss how AI / machine learning can be leveraged to automate certain procure-to-pay processes such that procure-to-pay teams can focus on core business goals.

What is the procure-to-pay cycle or process?

The procure-to-pay (P2P) cycle or process is defined as a sequence of business process steps that procure goods and services and pay suppliers for these goods and services. The procure-to-pay process is not limited to the procurement department but often involves many different departments in order to procure goods and services across an organization. The procurement department is often responsible for coordinating procurements between suppliers, finance departments, and other business units.

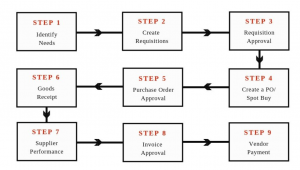

What are some of the key procure-to-pay process steps?

The procure-to-pay (P2P) process comprises process steps involving both procurement and finance. The following represents the detailed P&P cycle including key process steps:

- Requirements/demand planning: The first step of the P2P cycle is the identification of a need. The needs for goods and services are often identified by the finance department or different business units. The requirement for the goods and services are then approved by management and procurement can begin to procure the goods. This step is also called the creation of approved purchase requisition. A purchase request is an internal document that describes the goods and services required by a business unit. The business units can implement machine learning models for demand forecasting and optimization to better understand their future demand and procure the goods they need in a timely manner. An example is an organization that needs analytics software for reporting that has been approved by management plans on purchasing the new software before it expires.

- P2P team accepting the purchase request: The procurement department receives the details of the purchase request and starts the procure-to-pay process. The purchase request is processed in terms of understanding the details including the price of the goods and services being requested. The procurement department then approves the purchase request and begins to procure goods from vendors or suppliers.

- Sourcing: The procure-to-pay (P&P) process then moves to the identification of suppliers and evaluation of their prices. Suppliers may be found through various means such as searching on a specific supplier database, trade shows, or asking for referrals from other business units or departments within an organization. There is a unique department called sourcing within procure-to-pay departments that is responsible for sourcing. The procure-to-pay process in a larger organization may have multiple sources in different countries and continents depending upon the organizations’ needs across geographies. This is an era of eSourcing. eSourcing is referred to as electronic sourcing, which represents the web-based systems that can be used to collect and compare information about several suppliers and help the buyers select the preferred suppliers.

- Raise RFI/RFP/RFQ and get the quotes from the approved suppliers: The approved suppliers are selected from the list of preferred suppliers based on certain criteria such as price and quality. The RFQ (request for quote) and/or RFP (request for proposal) are then issued to procure goods and services.

- Negotiating with the suppliers: Once the responses to RFQ and RFP are received, the procure-to-pay (P&P) department begins to negotiate prices for different goods or services with the potential suppliers. The procurement team may use a sourcing tool, spreadsheet, or other means in order to compare prices and choose which supplier will offer them the best price on their good or service. The P2P department agrees with the supplier on a price and negotiates other terms such as payment plans, delivery dates, etc.

- Supplier selection: The procure-to-pay (P2P) department then selects the supplier who is best suited to meet their needs and orders goods or services from them.

- Raise the purchase orders (POs) to the suppliers: Once a deal is agreed upon between the procure-to-pay team and the supplier, it’s time to issue an official purchase order (PO) or service contract. A purchase order is a document created by the procure-to-purchase (PTP) team that describes what goods are being ordered, how many of these goods need to be delivered, as well as other important information such as the payment terms, delivery dates, and so on. While creating the purchase order, payment terms such as net 30 (Net 30 Days), net 60 (Net 60 Days), net 90 (net 90 days) are agreed upon. Setting the optimal payment terms is critical in the procure-to-pay process as it directly affects the cash flow of the company.

- Received the goods and services from the suppliers: Once a purchase order is issued, procure-to-purchase teams wait for delivery of their ordered goods and deliverables from suppliers. The suppliers then begin to procure goods and services from their vendors or suppliers in order to deliver the goods. The procure-to-pay department then receives the purchased items and invoices to make sure that all goods and services were received as per the terms of the contract.

- Raise the receipt or book the inventory: Once the goods and services are received, a goods receipt note (GRN) or the inventory booking is raised to the procure-to-pay (P&P) department depending upon the accounting and finance process. The GRN or bookings are then updated in the procure-to-pay system after it’s been approved by the PTP team. Appropriately, if the goods received are not as desired, a material return note (MRN) is raised.

- Receive invoices from suppliers: The procure-to-pay (P&P) department receives and processes supplier invoices in order to make sure that payment is made on time. Invoice processing begins when the procure-to-pay (P&P) department receives delivery confirmations from suppliers. The procure to pay team then goes over all purchase orders and verifies if items were received, invoices were generated by the supplier, and examines prices of goods or services in order to make sure that the price paid was correct and negotiated well with the supplier.

- Send the supplier invoices to the finance department to kickstart the payment process: After receiving the goods, procure-to-pay processes move on to pay for these items on time through various means including electronic transfer, cheques, etc. The invoices are scanned and sent to the accounts payable department for accounting. The procure-to-pay (PTP) team may also choose to send the invoices directly into a workflow management system or another procure-to-purchase system that automates different procure-to-payment processes. The procure-to-pay (PTP) department can also send the invoices to other departments such as accounts payable or accounts receivable depending upon the requirements of a specific organization.

- Process the invoices: The invoices are then reviewed by the accountants. The invoices are reviewed for proper approvals, overdue, or under-deliveries. The procure-to-pay (PTP) team then enters these invoices into their procure-to-pay systems if available. If there is no procure to purchase the system at hand, then they can just enter it into a spreadsheet or any other procure-to-purchase system.

- Approve & release the payment: Once the invoices are reviewed, the payment team then issues the required checks or electronic transfers in order to pay out these invoices based on the payment terms. The procure-to-pay (P2P) team then enters or uploads these invoices into their procure-to-pay systems as completed.

- Post payment confirmation: Once the invoice is paid, a confirmation email containing scanned images of checks and electronic transfer receipts is sent out by procure-to-pay teams. This completes the procure to pay process

- Ensure compliance adherence: Every organization has its own internal policies for procurement which are designed to meet its business objectives. The procure-to-pay (P&P) team ensures that the procurement process conforms to these policies and guidelines at all times in order to maintain compliance with internal regulations, tax laws, etc.

- Supplier performance evaluation: At regular intervals, supplier performance will be evaluated based on their procure-to-pay (P2P) scorecard. This enables the P2P team to make changes in supplier contracts and renew existing ones with suppliers who are performing well or drop unproductive suppliers from future procurements.

What are different machine learning use cases in procure-to-pay process steps?

The following are different machine learning use cases in procure-to-pay process steps:

- Demand forecasting and optimization: Business units can leverage machine learning models in procure-to-pay process steps in order to predict future demand for specific goods or services based on historical data and machine learning algorithms. This helps organizations procure these items before they become out of stock or run out of storage space. Inventory levels can be predicted which helps P2P teams gauge the inventory in advance and take proactive measures in case there is a shortage of goods or materials, etc. This helps organizations procure these items before it’s too late.

- Demand anomaly detection: The procure-to-purchase (P2P) team can use machine learning models to detect fraud cases. For instance, if the purchase orders are being issued by a particular department on behalf of another one, this is a potential red flag.

- Supplier risk assessment: In procure-to-pay process steps, machine learning models can be used to identify any possible risks for a particular supplier or vendor in terms of delivery times and the number of goods being delivered on time which might have an impact on procure-to-purchase (PTP) processes.

- Sourcing: In procure-to-pay (P2P) processes, machine learning models can be leveraged to search, compare and identify/classify a specific supplier based on their past performance which has been learned by machine learning algorithms. A sourcing search engine can be built for procure-to-purchase (PTP) teams to search and compare different suppliers based on different parameters. The search engine can leverage advanced NLP techniques to perform semantic searches.

- Bid prediction: The procure-to-pay (P2P) team can use advanced machine learning techniques to predict the probability or likelihood of winning a supplier winning a bid. This will help procure-to-pay (P2P) teams identify their top bidders so that they can focus on them more strategically instead of wasting time and money bidding against other organizations.

- Supplier scorecards/ranking: Machine learning models can be used to rank the suppliers based on historical datasets including but not limited to pricing, response time, and other parameters. This can help in sourcing and procure-to-pay (PTP) processes.

- Pricing optimization using should cost model: Should cost modeling is a machine learning technique that helps procure-to-pay (PTP) teams to estimate the cost of a good or service before they procure them. The machine learning models use historical data in order to predict the price range at which these goods should be purchased. Should cost model can be used to predict the price points for goods and services based on internal and external factors including historical data, seasonality, etc. This helps organizations negotiate in a better manner and procure these items at a cheaper rate as opposed to paying for a higher price.

- Payment terms optimization: Machine learning algorithms can be applied in procure-to-pay (P2P) processes to predict future payment terms for a supplier. This can enable the procurement team to have the business allocate the cash in appropriate areas to procure goods and services. Optimizing payment terms for suppliers is an optimization problem that uses machine learning models to predict future payment terms which can help procure-to-pay (P2P) teams optimize cash flow.

- Invoices digitization: Machine learning models (OCR techniques) can be used to extract data from scanned invoices which helps procure-to-pay (PTP) teams save time and effort on manually entering the same.

- PO and invoice reconciliation: Procure-to-pay (PTP) teams can use machine learning models (OCR & NLP techniques, string matching, etc) to reconcile purchase orders (POs) and invoices. This helps avoid any discrepancies at a later stage which not only saves time but also ensures that procurements are carried out as per the internal policies of an organization.

- PO search engine: Purchase orders (PO) search engine can be used to search and retrieve historical procurements carried out in the organization. This information can be leveraged to look for patterns, trends or discrepancies in procure-to-pay (PTP) processes.

Procure-to-pay (P2P) processes are an integral part of many companies’ operations. AI / Machine learning can be used to optimize procurements by providing recommendations on how much cash should go where, which suppliers provide the best value for money, and what price points items should be purchased at. These machine learning models also help with other procure-to-pay tasks including sourcing, invoice digitization, reconciliation of purchase orders and invoices as well as bid prediction. If you’re looking for more information about how your company can use machine learning in procure-to-purchase (P2P) process workflows or if you need help implementing these techniques into your current P2P practices, let us know!

- The Watermelon Effect: When Green Metrics Lie - January 25, 2026

- Coefficient of Variation in Regression Modelling: Example - November 9, 2025

- Chunking Strategies for RAG with Examples - November 2, 2025

I found it very helpful. However the differences are not too understandable for me